Solver Network

Liquidity Rebalancing

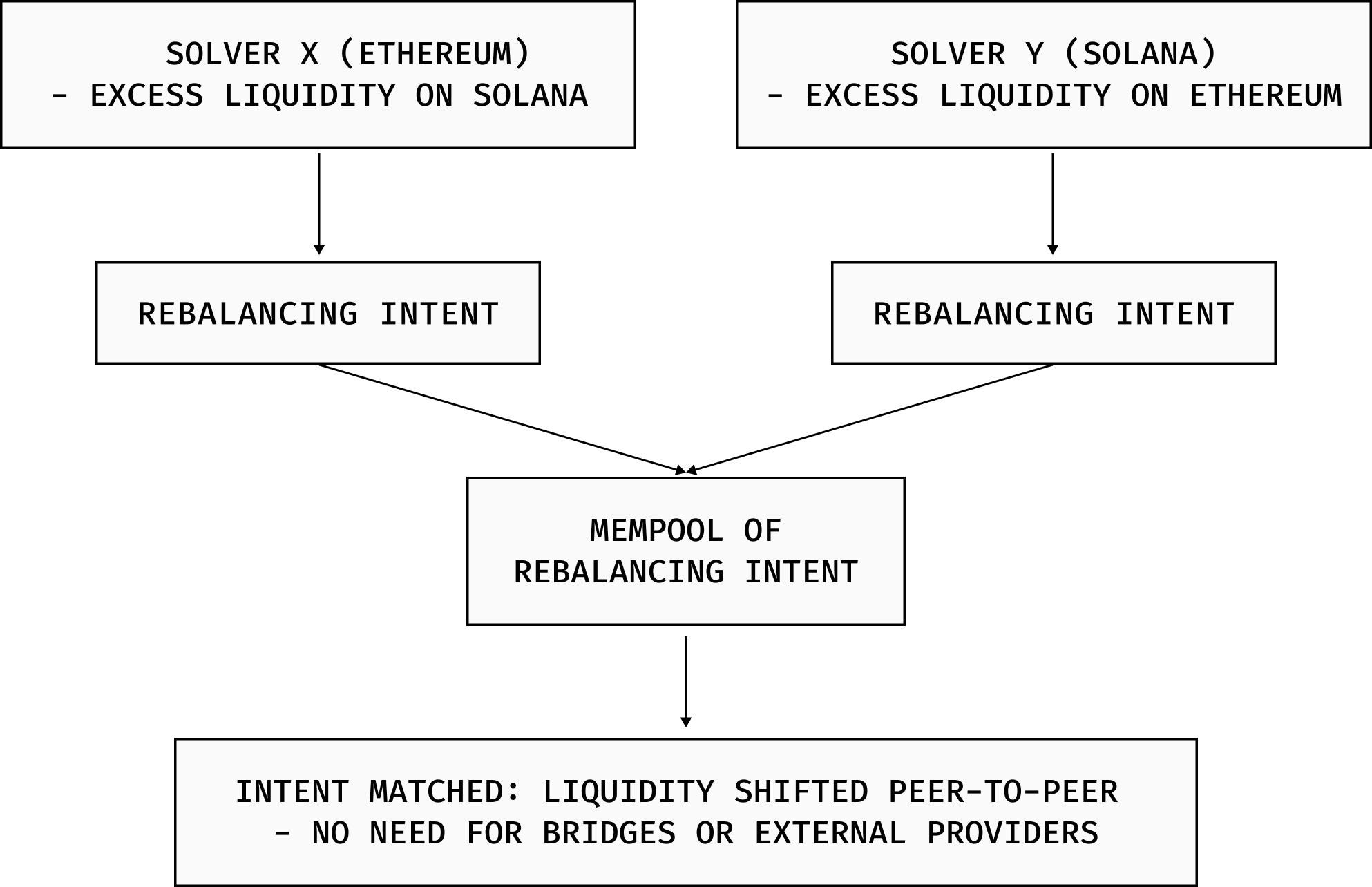

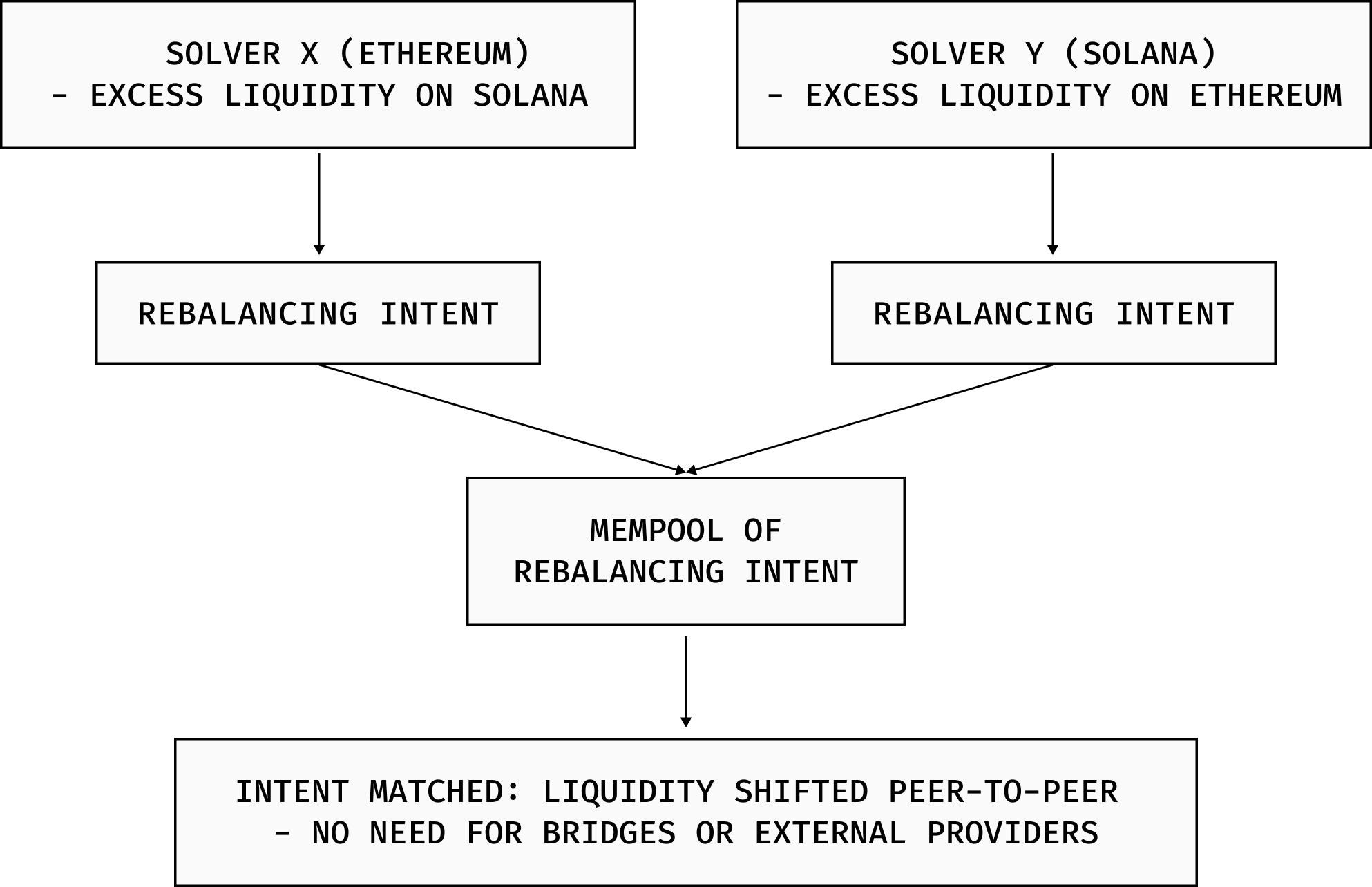

Solvers manage their own liquidity across multiple chains, but maintaining balance across dif-

ferent ecosystems is challenging. To prevent inactive liquidity buildup, solvers proactively generate

rebalancing intents, which are fulfilled by other solvers that need opposite liquidity shifts.

Example scenario: SolverX(Ethereum)has excess liquidity on Solana but wants to move it back to

Ethereum. Solver Y(Solana) has excess liquidity in Ethereum and wants to move it to Solana. Instead

of using bridges or external liquidity providers, Solver X and Solver Y fulfill each other’s rebalancing

intents, ensuring that both solvers retain liquidity within their own systems. This decentralized

liquidity rebalancing mechanism improves capital efficiency, prevents unnecessary fragmentation,

and reduces reliance on traditional liquidity bridges, which are prone to delays and security risks.